Gold and silver are both widely used precious metals in investment portfolios, but they serve different roles and exhibit distinct risk and return characteristics. Understanding these differences is essential before deciding how to allocate capital between the two.

Market Size and Liquidity

Gold is a significantly larger and more liquid market than silver. It is held extensively by central banks, sovereign institutions, and long-term investors. This deep liquidity contributes to gold’s role as a monetary asset and a reserve of value.

Silver’s market is smaller and more fragmented. While it is actively traded, it is more susceptible to supply disruptions, speculative flows, and short-term price swings.

Price Volatility

Silver is generally more volatile than gold. Its price movements tend to be more pronounced in both rising and falling markets. This higher volatility can create opportunities for short-term gains but also increases downside risk.

Gold typically exhibits lower volatility and more stable price behavior, particularly during periods of financial stress. This stability underpins its use as a defensive asset.

Industrial vs Monetary Demand

Gold demand is primarily driven by investment, central bank activity, and jewelry consumption. Its price is heavily influenced by macroeconomic factors such as real interest rates, currency movements, and monetary policy.

Silver has a substantial industrial component, with demand tied to manufacturing, electronics, energy technologies, and medical applications. As a result, silver prices are more sensitive to economic growth cycles and industrial demand trends.

Performance Across Economic Cycles

During periods of economic expansion and rising industrial activity, silver has often outperformed gold due to increased industrial demand and speculative interest.

In contrast, during recessions, financial crises, or periods of heightened uncertainty, gold has typically demonstrated greater resilience. Its safe-haven characteristics tend to attract capital when confidence in growth assets declines.

Investment Vehicles and Accessibility

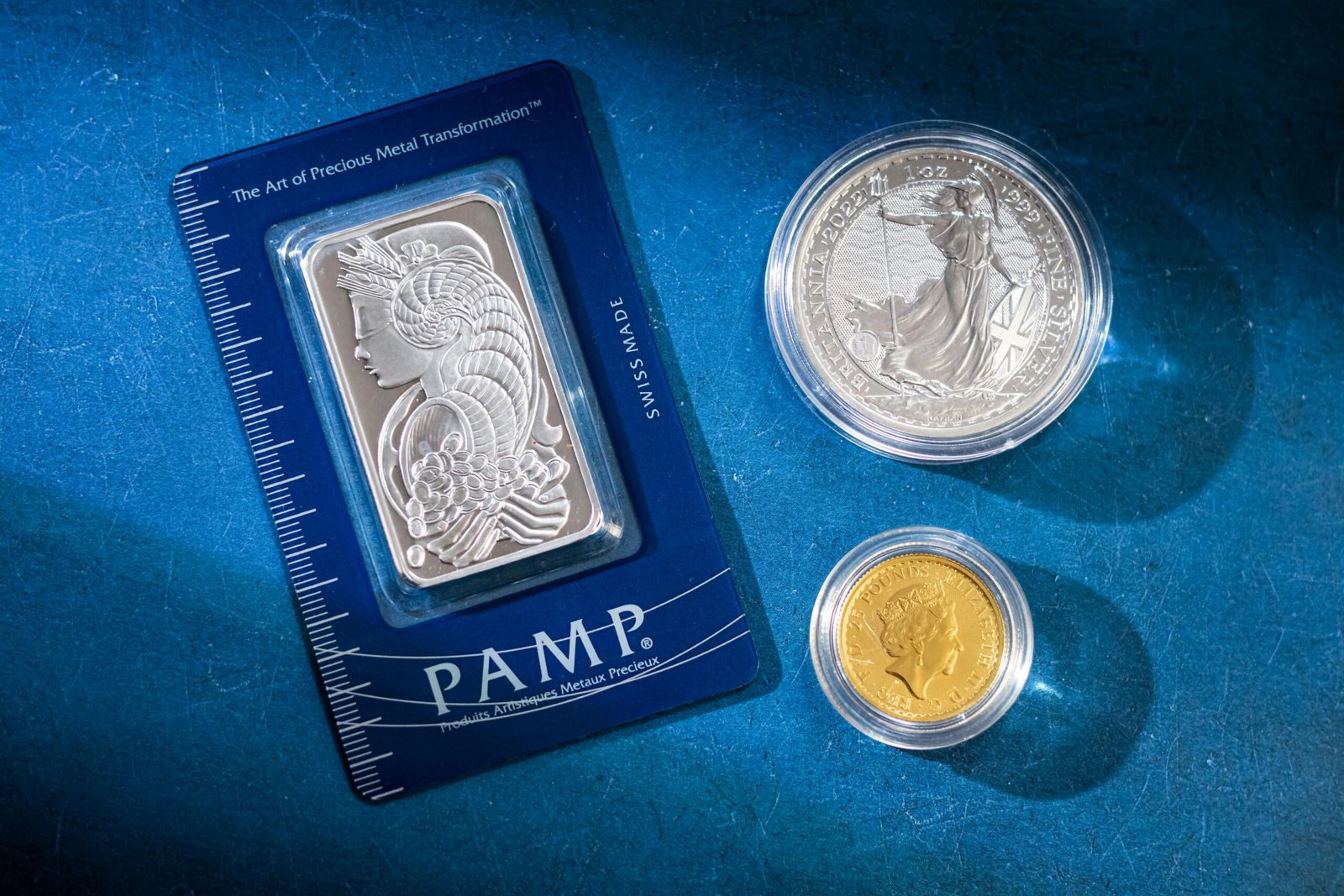

Both metals can be purchased in physical form, including coins and bars, or through financial instruments such as exchange-traded products and mining equities.

Silver’s lower price per ounce makes it more accessible to smaller investors, but storage costs can be proportionally higher due to bulk and weight. Gold is more efficient to store in larger values but has a higher entry price per unit.

Portfolio Role and Risk Management

Gold is commonly used as a portfolio stabilizer and hedge against monetary and financial risk. Its primary function is capital preservation rather than aggressive growth.

Silver is often treated as a hybrid asset, combining elements of a precious metal and an industrial commodity. It may enhance returns in favorable conditions but can also increase portfolio volatility.

Which Is More Appropriate?

The choice between gold and silver depends on investment objectives and risk tolerance. Investors seeking stability, diversification, and protection against systemic risk typically favor gold. Those willing to accept higher volatility in pursuit of potentially higher returns during economic expansions may allocate to silver.

Many investors choose to hold both metals, using gold as a defensive anchor and silver as a more cyclical complement.

Conclusion

Gold and silver are not interchangeable investments. Each responds differently to economic, monetary, and market conditions. Understanding their respective roles allows investors to make more informed allocation decisions and integrate precious metals more effectively into a diversified portfolio.