Investing in gold begins with a fundamental decision: how to gain exposure. Gold can be owned directly in physical form or accessed through financial structures such as exchange-traded funds and retirement accounts. Each method offers distinct advantages, risks, and use cases. Understanding these differences is essential to selecting the approach that aligns with investment objectives, time horizon, and risk tolerance.

Physical Gold Ownership

Physical gold includes coins, bars, and bullion products that provide direct ownership of the metal. This method is often associated with long-term wealth preservation and protection against systemic financial risk.

Advantages

Physical gold carries no counterparty risk. Ownership is not dependent on financial institutions, custodians, or market infrastructure. In periods of severe financial stress, this independence is often viewed as a key benefit. Physical gold also provides privacy and control, particularly when stored outside the banking system.

Physical gold can be held indefinitely without reliance on market liquidity, making it suitable for investors with long-term horizons and a focus on capital preservation rather than trading.

Limitations

Physical ownership introduces practical considerations. Secure storage, insurance, and transportation all carry costs. Liquidity can be lower than financial instruments, particularly for large bars or less-recognized products.

Pricing includes dealer premiums above the spot price, and selling typically involves bid-ask spreads. These factors can reduce short-term efficiency compared with paper-based alternatives.

Who It Suits

Physical gold is best suited for investors seeking long-term security, protection from financial system risk, and direct ownership without intermediaries.

Gold Exchange-Traded Funds (ETFs)

Gold ETFs provide exposure to gold prices through shares traded on stock exchanges. These funds are typically backed by physical gold held in custody and are designed to track the spot price of gold.

Advantages

ETFs offer high liquidity, transparency, and ease of access. They can be bought and sold intraday through brokerage accounts, making them efficient for tactical positioning or portfolio rebalancing.

ETFs eliminate the need for personal storage and insurance, and transaction costs are generally lower than those associated with buying and selling physical gold.

Limitations

While gold ETFs are backed by physical metal, investors do not own specific bars. Ownership is indirect and subject to fund structure, custodial arrangements, and regulatory frameworks.

ETFs also introduce counterparty and operational risk. In extreme scenarios, access to shares or redemption mechanisms could be impaired, even if the underlying gold remains intact.

Who It Suits

Gold ETFs are appropriate for investors seeking price exposure, liquidity, and convenience, particularly within traditional investment portfolios.

Gold IRAs and Retirement Accounts

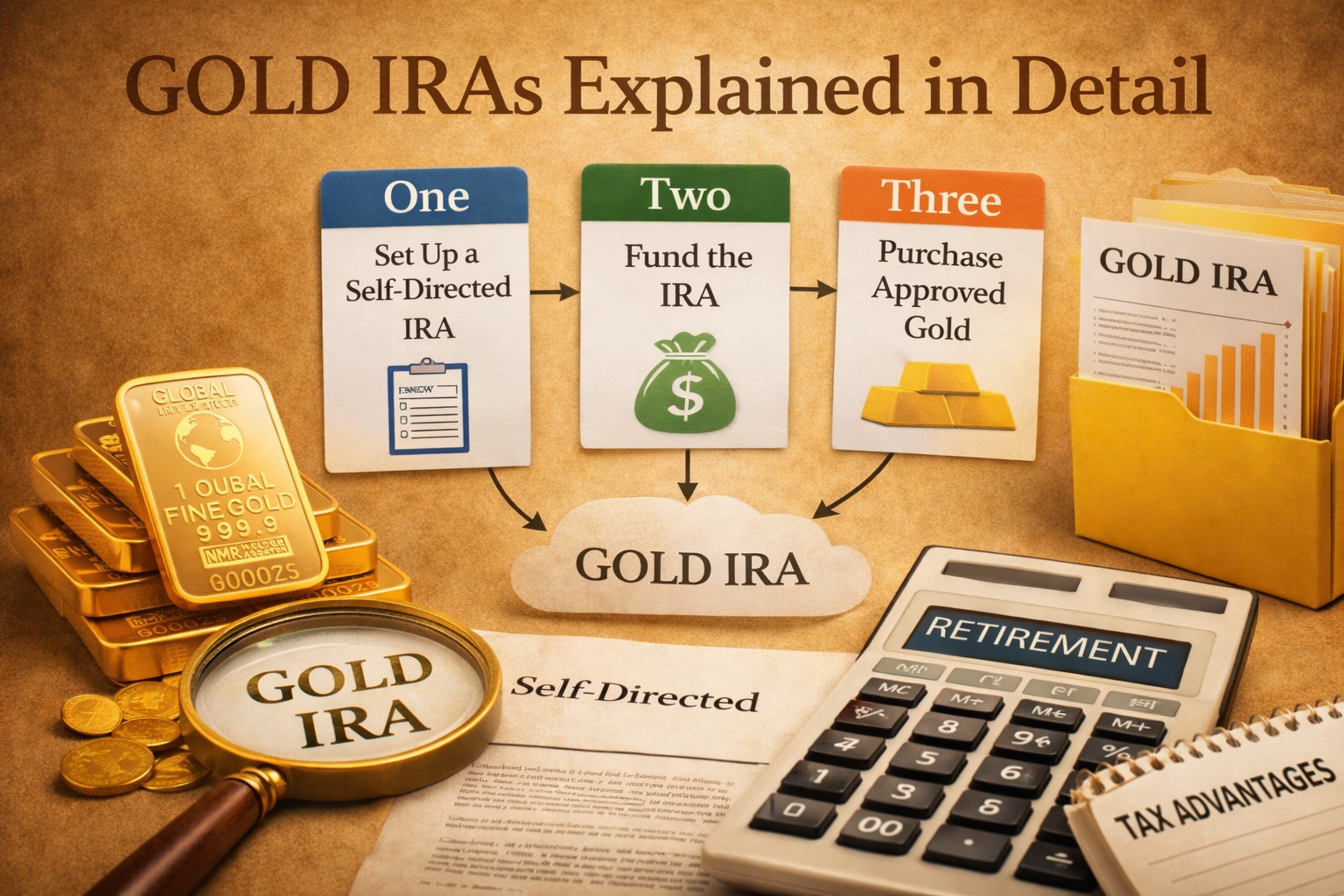

Gold can also be held within certain tax-advantaged retirement accounts, commonly referred to as gold IRAs. These accounts allow investors to include physical gold or gold-related assets within a retirement framework.

Structure and Requirements

Gold IRAs are typically self-directed accounts that require approved custodians and specific types of investment-grade gold. The metal must be stored in approved depositories, and strict regulatory requirements apply.

Advantages

Holding gold within a retirement account can offer tax deferral or tax-free growth, depending on the account structure. For long-term retirement planning, this can enhance after-tax outcomes while maintaining exposure to gold.

Gold IRAs allow investors to integrate gold into retirement portfolios without sacrificing the benefits of tax-advantaged accounts.

Limitations

Gold IRAs involve higher complexity and costs. Setup fees, custodial fees, and storage charges can be significant. Liquidity is also more restricted than with ETFs, and early withdrawals may trigger penalties.

Investors must comply with regulatory rules regarding eligible products, storage, and distributions.

Who It Suits

Gold IRAs are most appropriate for long-term investors who want gold exposure within a retirement framework and are willing to accept higher costs and administrative complexity.

Comparing the Three Methods

Each method represents a trade-off between control, liquidity, cost, and complexity.

Physical gold emphasizes ownership and security but requires hands-on management. ETFs prioritize liquidity and efficiency but rely on financial infrastructure. Gold IRAs integrate gold into long-term retirement planning but introduce regulatory and cost considerations.

There is no universally superior method. The appropriate choice depends on how gold is intended to function within the broader portfolio.

Using Multiple Methods

Many investors choose to combine methods. Physical gold may serve as a long-term store of value, while ETFs provide liquidity and flexibility for portfolio management. Retirement accounts can complement both by incorporating gold into long-term planning.

This layered approach allows investors to balance accessibility, security, and tax considerations.

Conclusion

Choosing the right gold investment method is a strategic decision that shapes how gold functions within a portfolio. Physical gold, ETFs, and gold IRAs each offer distinct advantages and limitations.

By aligning the method of ownership with investment goals, risk tolerance, and time horizon, investors can use gold more effectively as a tool for diversification, risk management, and long-term capital preservation.