Gold individual retirement accounts (IRAs) allow investors to hold physical gold and other approved precious metals within a tax-advantaged retirement structure. These accounts are designed for long-term investors who want to diversify retirement savings beyond traditional stocks and bonds while retaining the benefits of deferred or tax-free growth.

While gold IRAs are often discussed alongside physical gold investing, they operate under a distinct legal and administrative framework. Understanding how gold IRAs work, their advantages, limitations, and risks is essential before considering them as part of a retirement strategy.

What Is a Gold IRA?

A gold IRA is a form of self-directed IRA that permits investment in physical precious metals, most commonly gold, but also silver, platinum, and palladium under specific conditions. Unlike standard IRAs, which typically hold mutual funds, ETFs, or bonds, a gold IRA holds tangible assets stored in approved depositories.

Gold IRAs follow the same basic tax rules as traditional or Roth IRAs. Contributions, withdrawals, and penalties are governed by existing retirement account regulations. The key difference lies in the types of assets permitted and the custody requirements.

Gold IRAs do not allow personal possession of the metals. The gold must be held by a qualified custodian and stored in an approved facility.

Eligible Types of Gold

Not all gold products qualify for inclusion in a gold IRA. The Internal Revenue Code specifies minimum purity standards and approved product categories.

Investment-grade gold must generally meet a minimum purity of 99.5%. Eligible products typically include certain bars and widely recognized bullion coins produced by accredited mints or refiners.

Collectible or numismatic coins are not permitted, even if they contain gold. This restriction is designed to ensure that retirement accounts hold standardized, investment-grade assets rather than speculative collectibles.

The list of eligible products is specific, and investors must rely on custodians and dealers to ensure compliance.

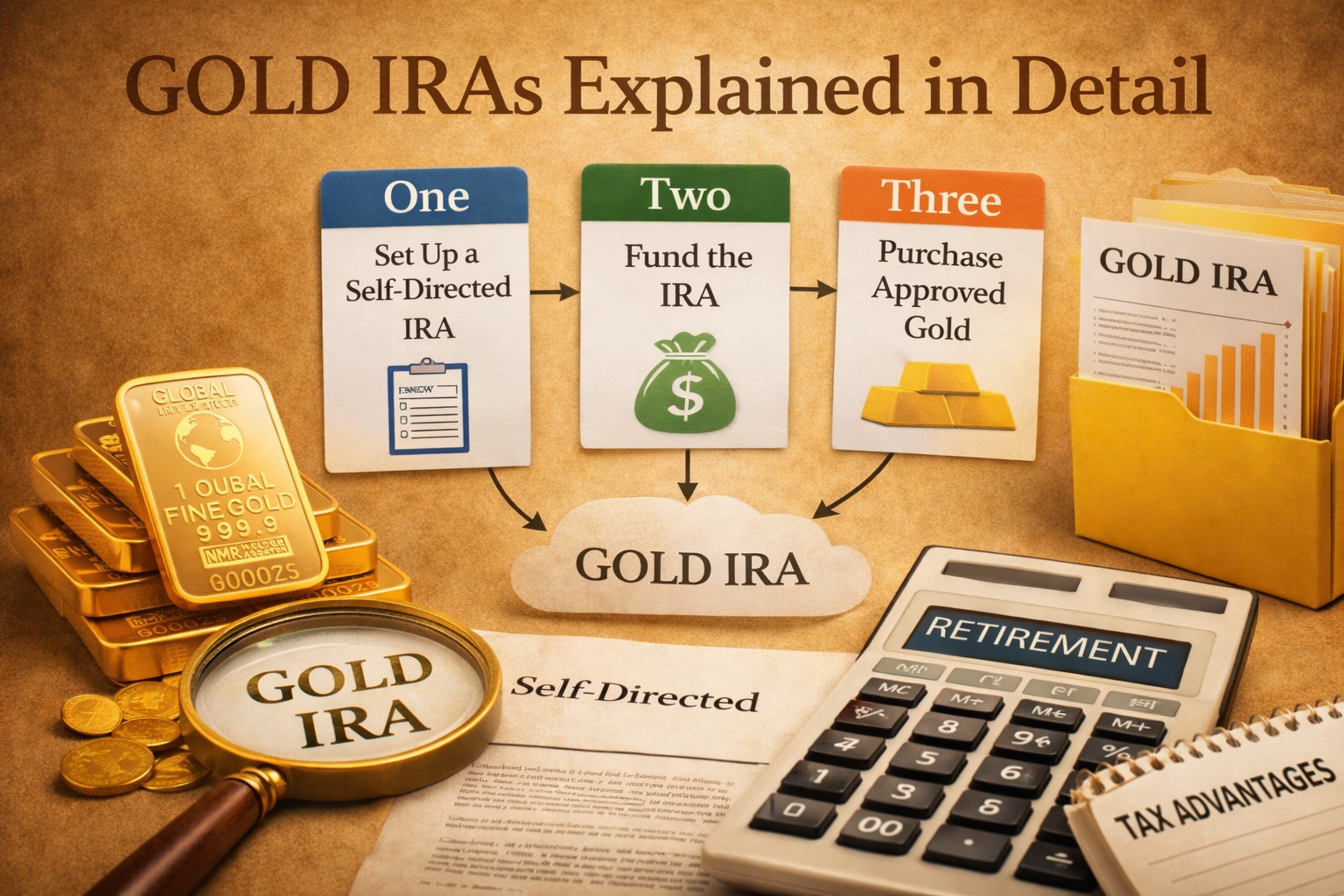

How Gold IRAs Are Structured

Gold IRAs require three primary parties: the account holder, a custodian, and a storage depository.

The Custodian

The custodian administers the IRA, handles reporting requirements, ensures regulatory compliance, and executes transactions on behalf of the account holder. Custodians are typically banks, trust companies, or specialized firms authorized to manage self-directed IRAs.

The Depository

Physical gold held in a gold IRA must be stored in an approved depository. These facilities provide secure storage, insurance, and auditing. Storage is typically either allocated, where specific bars or coins are held for the account, or segregated, where assets are physically separated from those of other clients.

The Account Holder

The investor directs investment decisions, including which metals to purchase and when to buy or sell, within the constraints of the IRA rules.

This structure is designed to preserve the tax-advantaged status of the account while ensuring proper custody and oversight.

Funding a Gold IRA

Gold IRAs can be funded in several ways.

Contributions

Investors may make annual contributions, subject to standard IRA contribution limits. These contributions can be used to purchase approved gold through the custodian.

Rollovers and Transfers

Many gold IRAs are funded through rollovers or transfers from existing retirement accounts, such as traditional IRAs, Roth IRAs, or employer-sponsored plans. Proper execution is critical, as errors can trigger taxes or penalties.

Direct trustee-to-trustee transfers are generally preferred, as they reduce the risk of inadvertent distribution.

Tax Treatment and Withdrawal Rules

Gold IRAs follow the same tax treatment as other IRAs, depending on account type.

Traditional Gold IRAs

Contributions may be tax-deductible, and investment gains are tax-deferred. Withdrawals are taxed as ordinary income. Required minimum distributions apply once the account holder reaches the applicable age.

Roth Gold IRAs

Contributions are made with after-tax dollars, but qualified withdrawals are tax-free. Roth gold IRAs do not have required minimum distributions during the account holder’s lifetime.

Early withdrawals from either type of account may be subject to penalties, regardless of whether the distribution is taken in cash or physical metal.

Costs and Fees

Gold IRAs generally involve higher costs than conventional retirement accounts.

Common fees include account setup charges, annual custodial fees, storage fees, and transaction costs when buying or selling metals. These expenses can vary widely depending on the custodian, storage arrangement, and account size.

Because gold does not generate income, ongoing fees must be weighed carefully against the diversification benefits the asset provides.

Liquidity and Distributions

Gold IRAs are designed for long-term retirement savings, not short-term liquidity. Selling metals within the account typically requires coordination with the custodian and dealer, and settlement times may be longer than for traditional securities.

At distribution, account holders may choose to liquidate metals for cash or, in some cases, take physical delivery. Either option is treated as a taxable event for traditional IRAs.

Understanding distribution mechanics in advance is essential for retirement planning.

Risks and Limitations

Gold IRAs introduce several risks and constraints that differ from both physical gold ownership and traditional retirement investing.

Regulatory compliance is strict. Improper storage, ineligible products, or prohibited transactions can result in loss of tax-advantaged status.

Gold prices can be volatile, and gold may underperform other assets for extended periods. Because gold does not compound through earnings or dividends, opportunity cost is a meaningful consideration.

Additionally, gold IRAs do not eliminate counterparty risk entirely. Investors rely on custodians, depositories, and regulatory frameworks to maintain account integrity.

Role of Gold IRAs in a Retirement Portfolio

Gold IRAs are typically used as a diversification tool rather than a core retirement holding. They may be appropriate for investors concerned about inflation risk, currency debasement, or systemic financial instability over long horizons.

For most investors, gold exposure represents a portion of a broader retirement strategy that includes equities, bonds, and other assets.

Position sizing is critical. Overconcentration in gold can limit long-term growth potential, particularly in environments favorable to productive assets.

Conclusion

Gold IRAs provide a regulated way to hold physical gold within a tax-advantaged retirement account. They offer diversification benefits and protection against certain macroeconomic risks, but they also introduce higher costs, complexity, and regulatory constraints.

For investors with long-term horizons and a clear understanding of gold’s role in retirement planning, gold IRAs can serve as a complementary component within a diversified portfolio. Their effectiveness depends on disciplined allocation, careful custodian selection, and realistic expectations about gold’s long-term performance relative to traditional assets.